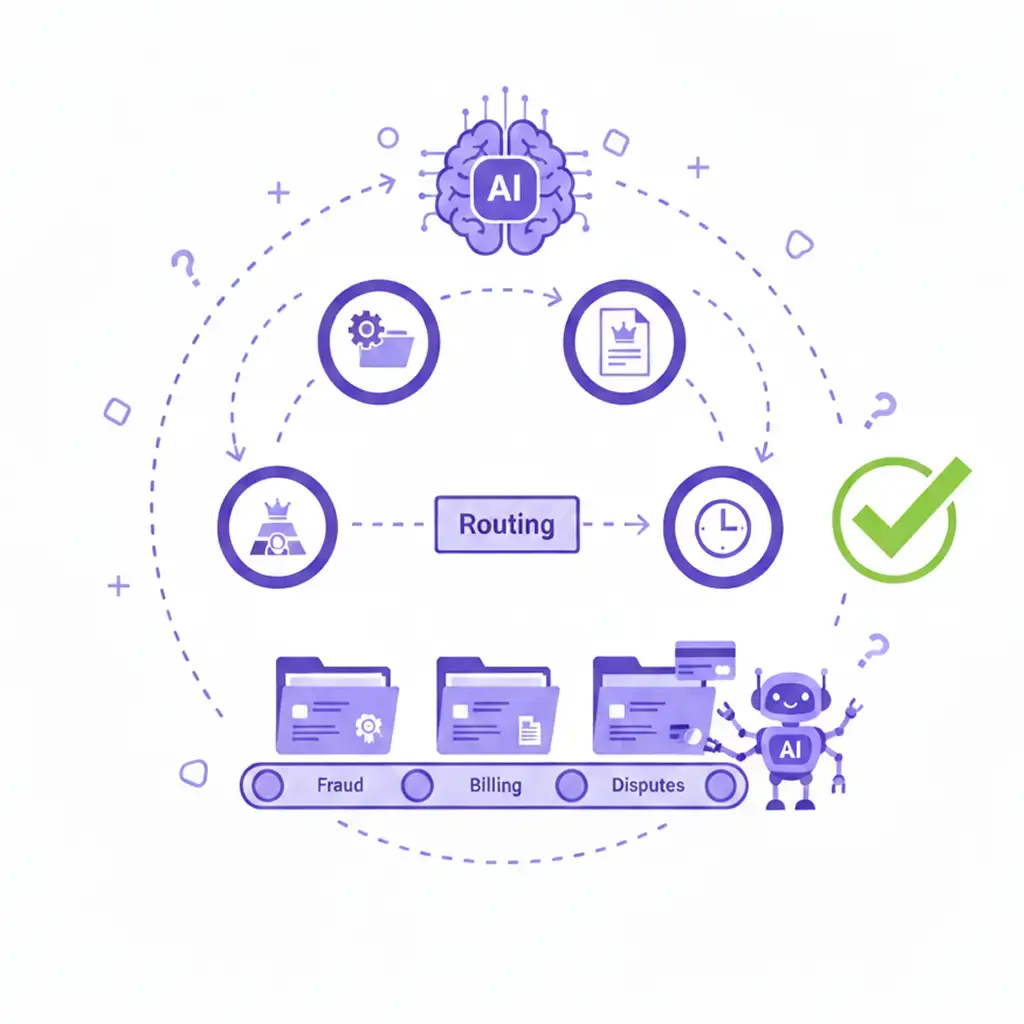

Can the AI categorize and prioritize card complaints?

Yes, it can evaluate complaint type, fraud indicators, customer tier, and urgency based on predefined criteria.

How are complaints routed to departments?

Via voice calls, SMS, WhatsApp, and email – with complete complaint details and customer information.

Can it handle multiple card complaint types?

Yes, AI can manage fraud disputes, billing errors, unauthorized transactions, and service complaints.

Does it support fraud detection integration?

Yes, it can integrate with fraud detection systems and flag suspicious activities automatically.

Can customers check status without calling agents?

Yes. Customers can call back anytime to check resolution status, provide information, or escalate issues.

How does it handle dispute processing?

AI can initiate dispute processes, collect supporting documentation, and track resolution timelines automatically.

Does AI Calling support human handover to agents?

Yes, our AI Calling platform seamlessly supports human handover to live agents with full conversation context. When a call requires human intervention, the AI transfers the caller to an agent while providing complete conversation summary, collected customer data, and call context to ensure smooth continuation.

Which telephony options can we use with AI Calling?

AI Calling supports multiple telephony options including SIP trunks, Twilio integration, and existing phone numbers. Our platform can map your current routing infrastructure without disruption, ensuring minimal downtime during implementation while maintaining your existing phone system.

How fast can we deploy AI Calling and go live?

Simple AI Calling deployments typically go live within a few days. For complex implementations with custom integrations, advanced routing, or specialized workflows, deployment typically takes 1–2 weeks. Our team provides dedicated support throughout the implementation process.

Do you support multiple languages and voice options?

Yes, AI Calling offers extensive multilingual support with 1000+ natural-sounding voices across 100+ languages and dialects. This ensures your automated calls can effectively communicate with diverse customer demographics while maintaining professional, culturally appropriate voice quality.

How is customer data protected in AI Calling?

Customer data security is our top priority. All data is encrypted in transit and at rest using enterprise-grade encryption. Access is controlled through role-based permissions with comprehensive audit logs and configurable data retention policies to ensure compliance with privacy regulations.

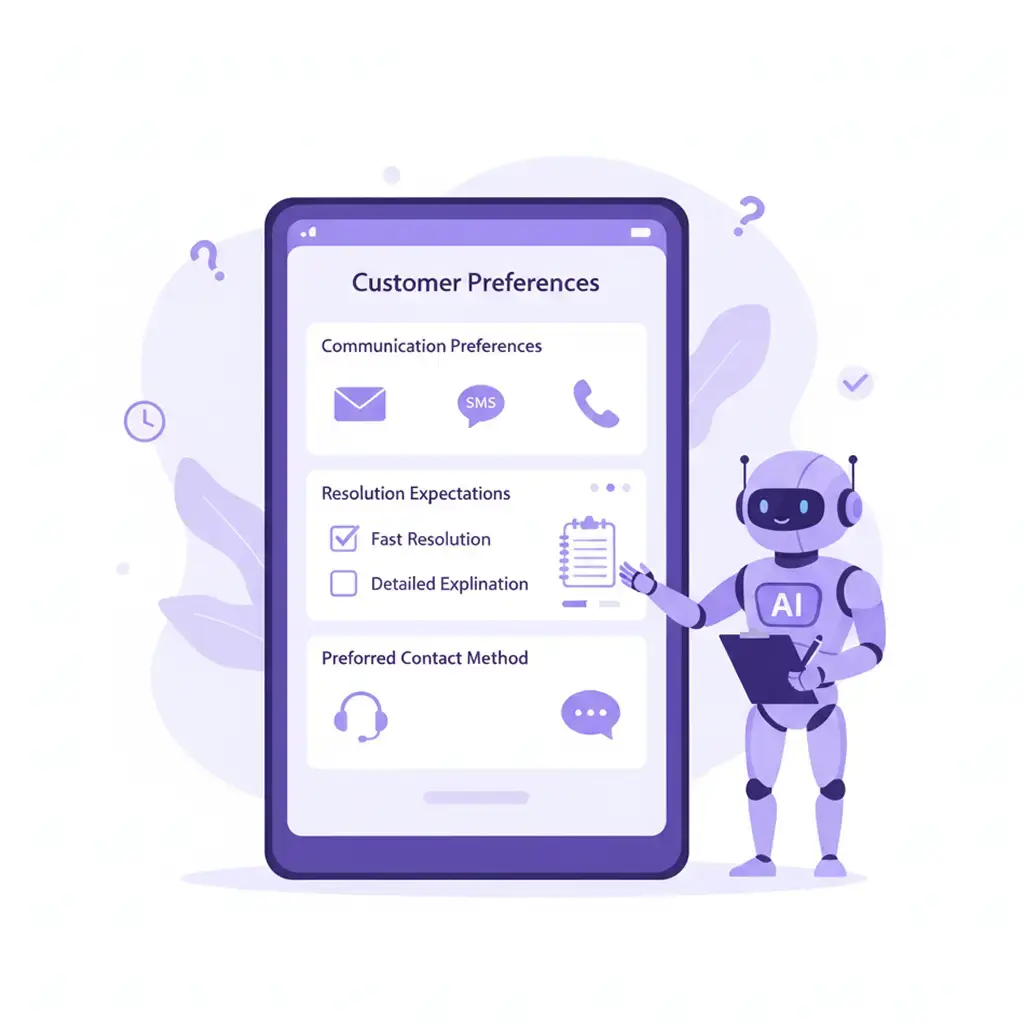

Can we customize AI prompts, call flows, and routing logic?

Absolutely. AI Calling provides complete customization capabilities for prompts, call flows, business hours, and routing logic. Each use case can be tailored to your specific business requirements, ensuring the AI reflects your brand voice and handles scenarios according to your processes.

What analytics and reporting are available?

Our comprehensive analytics dashboard includes call volumes, outcomes, transfer rates, customer satisfaction proxies, and funnel conversion metrics with detailed time-series trends. These insights help optimize your AI Calling performance and identify areas for improvement.

How does AI Calling pricing work?

AI Calling uses transparent, usage-based pricing on voice minutes consumed. Additional options include integrations, dedicated capacity, and premium features. Our pricing model scales with your usage, ensuring cost-effectiveness for businesses of all sizes.

Is call recording and transcription available?

Yes, AI Calling includes comprehensive call recording and transcription capabilities. Transcripts can be exported in multiple formats or automatically synced to your CRM and business systems, subject to consent requirements and compliance settings in your region.

Can we keep our caller ID private and maintain privacy?

Yes, caller ID masking is fully supported for privacy protection while maintaining callback continuity. This feature ensures your business number remains private during outbound calls while still allowing customers to call back using the same number.